Irs Public Records Tax Liens

Understanding a Federal Tax Lien | Internal Revenue Service - IRS tax forms

The IRS files a public document, the Notice of Federal Tax Lien, to alert creditors that the government has a legal right to your property. For more information, refer to Publication 594, The IRS Collection Process PDF . How to Get Rid of a Lien How a Lien Affects You Avoid a Lien Lien vs. Levy Help Resources How to Get Rid of a Lien

https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien

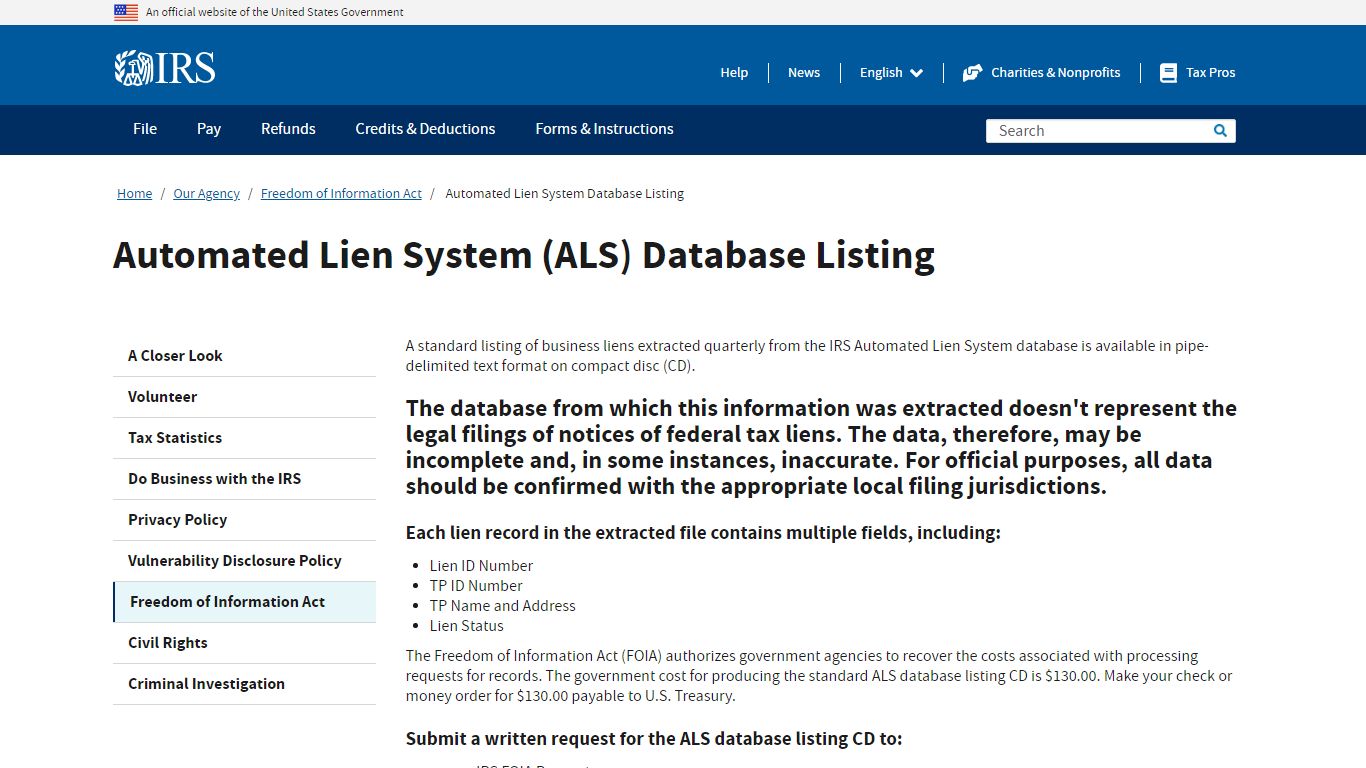

Automated Lien System (ALS) Database Listing - IRS tax forms

Lien Status The Freedom of Information Act (FOIA) authorizes government agencies to recover the costs associated with processing requests for records. The government cost for producing the standard ALS database listing CD is $130.00. Make your check or money order for $130.00 payable to U.S. Treasury.

https://www.irs.gov/privacy-disclosure/automated-lien-system-database-listing

5.17.2 Federal Tax Liens | Internal Revenue Service - IRS tax forms

The federal tax lien arises when any "person" liable to pay any federal tax fails to pay the tax after a demand by the Government for payment. IRC § 6321. For federal tax law purposes, a "person" is defined to include individuals, trusts, estates, partnerships, associations, companies, and corporations. IRC § 7701 (a) (1).

https://www.irs.gov/irm/part5/irm_05-017-002

Are IRS Payroll Tax Liens Public Record? - Clean Slate Tax

The short answer, unfortunately, is yes. Tax liens are made to be part of the public record which means anyone can look them up. Because of this, the existence of a tax lien can have a strong negative impact on your credit score. Credit companies will be able to access this information and adjust your credit reputation as a result.

https://cleanslatetax.com/are-irs-payroll-tax-liens-public-record/

IRS Liens - Tax

Selling or Refinancing when there is an IRS Lien This is the complete video, which is also divided into 3 segments below for convenience. It explains the federal tax lien discharge and subordination process. It walks through the application forms, supporting documents needed, how to submit an application, and how the process works.

https://www.tax.gov/Individual/IRSLiens

Routine Access to IRS Records | Internal Revenue Service - IRS tax forms

Copy of a tax return Transcript of your tax return or account Information from open case files Tax-exempt or political organization returns or other documents that are publicly available Tax forms and publications Your tax records Tax Court opinions Internal Revenue Code (IRC) For records not listed here Visit the IRS FOIA Library

https://www.irs.gov/privacy-disclosure/routine-access-to-irs-records

Notice of Federal Tax Lien Filed (in Public Records)

Notice of Federal Tax Lien Filed (in Public Records) Document filed with the local recording office that identifies tax liabilities owed by the taxpayer; establishes the government’s priority rights against certain other creditors.

https://www.taxpayeradvocate.irs.gov/tax-terms/notice-of-federal-tax-lien-filed-in-public-records/

Free Federal Tax Lien Search - SearchQuarry.com

Online Free Federal Tax Lien Search By Name In order to obtain a free federal tax lien search you can contact the IRS and see if they’ll send you an electronic copy. Many times they’ll charge a nominal fee for a certified copy. If you need a copy of your tax return the fee is nominal and it can be mailed to you.

https://www.searchquarry.com/free-federal-tax-lien-search/

A Step-by-Step Guide on How to Look Up a Federal Tax Lien - Clean Slate Tax

The IRS Centralized Lien Unit is a specialized department within the IRS that works to track lien payments. They are available by phone at (800) 913-6050. Secretary of State It may take time for liens to display in IRS records.

https://cleanslatetax.com/a-step-by-step-guide-on-how-to-look-up-a-federal-tax-lien/